They may need that you use a few of your reverse home loan funds to pay any overdue property costs. Your lender should be informed instantly if anyone who got the reverse home loan dies. For the most part, a making it through spouse will be allowed to remain in the property, however there might be additional requirements if the making it through partner was not on the original reverse home loan.

Here are a few of the most typical reverse home mortgage rip-offs and how to avoid them. You must never obtain money to put into "financial investment programs." Although in some cases this may be more dishonest than prohibited, unscrupulous monetary organizers may try to encourage you to take the cash out to invest in the market.

This typically involves a knock on the door by someone representing themselves as a friendly area handyman, with recommendations for work that they can do on the house. Ultimately, other professionals may start to recommend expensive repairs that might or might not require to be done, and after that suggest moneying them with a reverse home loan.

Only look for trusted repair work services from a licensed professional. If a member of the family all of a sudden and constantly starts asking about your financial condition, and recommends a power of attorney integrated with a reverse home mortgage, this could be a sign of inheritance scams. There are organizations that can assist if you think you are or a family member is a victim of any type of senior abuse.

A reverse mortgage is a mortgage made by a mortgage lending institution to a homeowner using the home as security or collateral. Which is considerably different than with a standard home loan, where the house owner utilizes their income to pay down the debt with time. However, with a reverse home mortgage, the loan quantity (loan balance) grows with time since the house owner is not making regular monthly home loan payments.

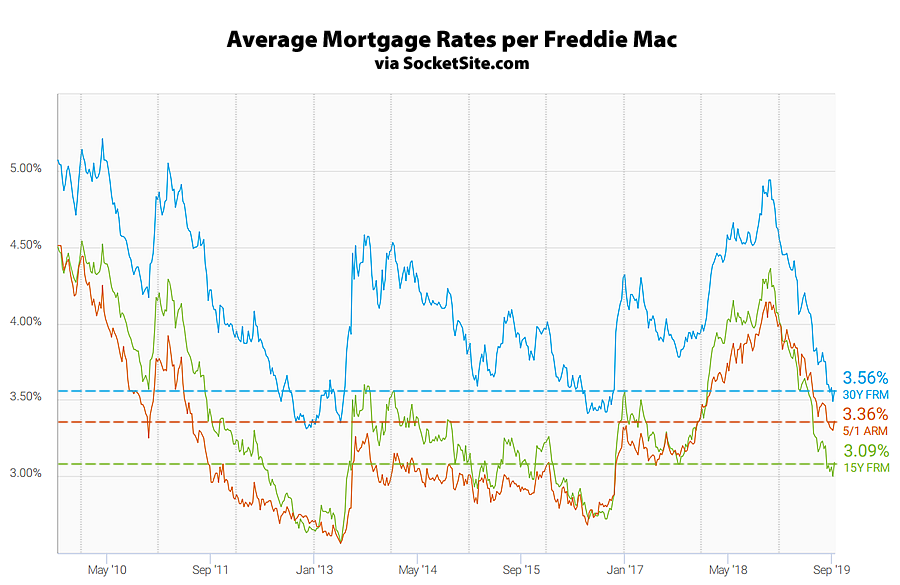

The amount of equity you can https://writeablog.net/aspaido3ib/b-table-of-contents-b-a-xrqt Have a peek at this website access with a reverse mortgage is identified by the age of the youngest borrower, existing rate of interest, and value of the house in question. Please note that you might require to set aside extra funds from the loan proceeds to pay for taxes and insurance.

They want to renovate their kitchen area. They have actually found out about reverse home loan but didn't know the information. They choose to get in touch with a reverse mortgage advisor to discuss their present requirements and future goals if they could get to a portion of the funds stored in their home's equity.

Indicators on Which Of The Following Statements Is Not True About Mortgages? You Need To Know

They presently owe $35,000 on their home mortgage. Below is an illustration of how John and Anne invest their loan proceeds. * This example is based upon Anne, the youngest customer who is 69 years old, a variable rate HECM loan with a preliminary rates of interest of 4.966% (which consists of a Libor index rate of 2.841% and a margin of 2.125%).

Rate of interest may vary and the mentioned rate might change or not be readily available at the time of loan dedication. * The funds offered to the customer may be restricted for the very first 12 months after loan closing, due to HECM reverse home mortgage requirements. In addition, the borrower may need to set aside extra funds from the loan proceeds to spend for taxes and insurance coverage.

Many actions are included prior to a new loan being funded and the property owner( s) to start receiving funds. We have actually supplied to you a fast visual example of what you might expect when beginning the procedure of a Home Equity Conversion Home Mortgage. how do escrow accounts work for mortgages. Next steps: Take a few moments to start estimating your eligibility utilizing our complimentary reverse home mortgage calculator.

A reverse mortgage, like a traditional mortgage, enables property owners to obtain cash using their home as security for the loan. Also like a standard home loan, when you secure a reverse home loan, the title to your home stays in your name. Nevertheless, unlike a conventional mortgage, with a reverse mortgage, customers don't make regular monthly home loan payments.

Interest and charges are included to the loan balance each month and the balance grows. With a reverse mortgage, house owners are needed to pay real estate tax and house owners insurance coverage, utilize the home as their principal home, and keep their house in great condition. With a reverse home loan, the amount the property owner owes to the lender goes upnot downover time.

As your loan balance increases, your house equity decreases. A reverse home loan is not totally free money. It is a loan where obtained cash + interest + fees every month = rising loan balance. The homeowners or their heirs will ultimately have to pay back the loan, typically by offering the house.

It might be a fraud. Do not let yourself be pressured into getting a reverse mortgage. The Department of Veterans Affairs (VA) does not use any reverse mortgage. Some home loan advertisements falsely promise veterans unique deals, suggest VA approval, or offer a "no-payment" reverse mortgage loan to draw in older Americans desperate to remain in their homes.

What Is The Current Index Rate For Mortgages for Beginners

This is called your right of "rescission." To cancel, you need to notify the lender in writing. Send your letter by qualified mail, and ask for a return invoice so that you have documentation of when you sent out timeshare wikipedia and when the lending institution got your cancellation notice. Keep copies of any interactions in between you and your loan provider.

If you think there is a factor to cancel the loan after the three-day duration, look for legal aid to see if you deserve to cancel. Keep in mind: This information just uses to Home Equity Conversion Home Loans (HECMs), which are the most common type of reverse mortgage loans.

A reverse home loan is a kind of loan that is utilized by property owners a minimum of 62 years old who have significant equity in their houses. By obtaining against their equity, seniors get access to cash to spend for cost-of-living expenses late in life, frequently after they've lacked other savings or income sources.

Think about a reverse home mortgage as a conventional home loan where the roles are changed. In a conventional home mortgage, a person secures a loan in order to purchase a house and then pays back the lending institution with time. In a reverse home mortgage, the person currently owns the house, and they obtain versus it, getting a loan from a lending institution that they may not necessarily ever repay.